[ad_1]

Douglas Rissing/iStock by way of Getty Illustrations or photos

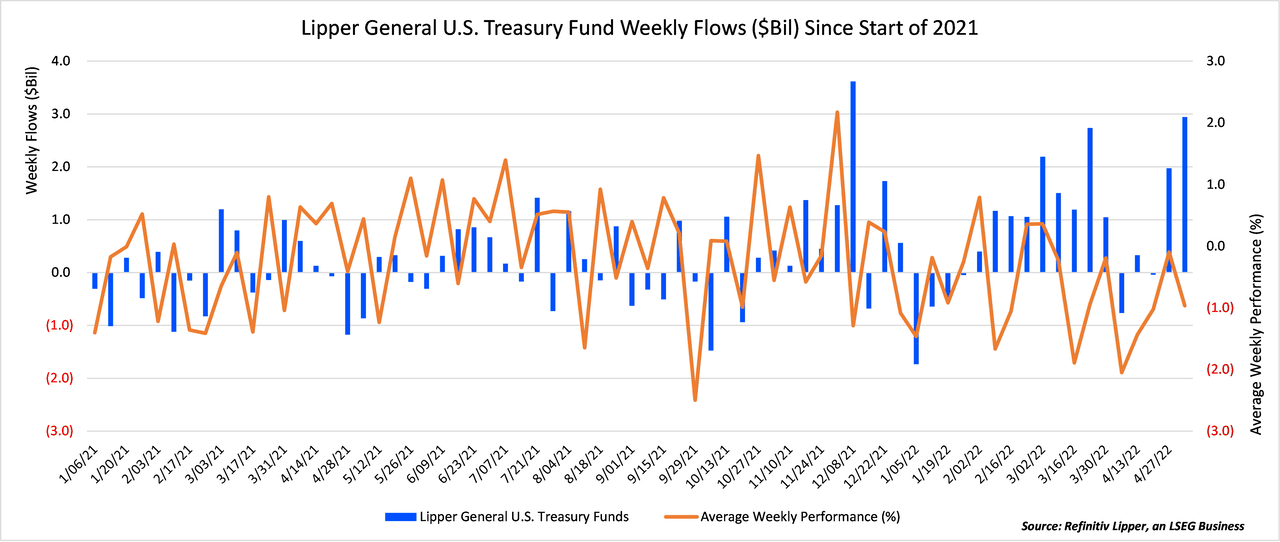

The Lipper Basic U.S. Treasury Funds classification is composed of money that devote primarily in U.S. Treasury expenditures, notes, and bonds. The funds in just this classification had an typical duration of 12.2 many years as of December 2021.

Compared to other significant fixed profits indices like the Bloomberg Municipal Bond Whole Return Index (-8.8%) and the Bloomberg U.S. Mixture Bond Total Return Index (-9.5%), Lipper Standard U.S. Treasury Cash have posted a quite underwhelming calendar year-to-day overall performance via April month stop of destructive 13.3%.

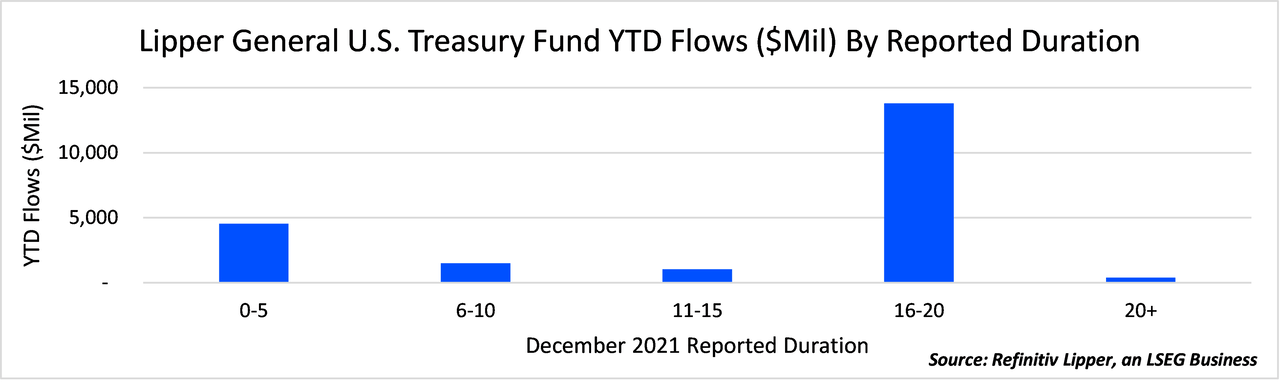

Irrespective of the lousy comparative overall performance, the classification led the way this earlier fund flows 7 days, attracting $3. billion. Lipper Normal U.S. Treasury Resources have also been crimson sizzling given that the get started of the 12 months, pulling in $21.4 billion, generating them the 3rd most well-known Lipper classification in that span – driving only Lipper Global Revenue Money (+$33.4 billion) and Lipper Mortgage Participation Resources (+$25.2 billion). Lipper Standard U.S. Treasury Money also established a quarterly intake report in the course of the fourth quarter of 2021 as they reported inflows of $13.9 billion.

Lipper Common US Treasury Resources (Writer) Lipper Common US Treasury Fund Flows (Author)

Wednesday, May well 4, the Federal Reserve policymakers decided they will raise prices by 50 foundation factors (bps) for the initially time in a lot more than 20 years. Though the considerable hike was largely anticipated, Federal Reserve Chair Jerome Powell noted that even bigger moves ended up not in the Fed’s upcoming ideas. It is however forecasted, on the other hand, that the Fed will raise prices all through each and every of its remaining meetings this year.

With the lousy efficiency of more time-dated Treasury bonds by now recognized through April, inflationary fears rising, and the present-day rising fees setting in place, the concern stands: Why have longer-dated U.S. Treasury Resources captivated so much capital this week and this 12 months?

To get the reply we could will need to choose a phase again. Fairness markets 12 months-to-day by means of April have logged even even worse returns than Lipper U.S. Normal Treasury Money – Nasdaq (-21.2%), Russell 2000 (-17.%), and S&P 500 (-13.3%).

The only U.S. broad-dependent equity index to outperform the classification was the DJIA (-9.25%). As interest fees rise, the higher-traveling, previously pricey expansion and engineering stocks are in for a tough trip. Principal defense, tax exemptions, and certain rates of return come to be even extra essential as the economy would seem to be heading toward turbulent periods.

Hazard mitigation and diversification are two phrases that have appeared to have turn into less pretty all through the earlier bull current market. Goldman Sachs’ financial workforce just previous thirty day period forecasted there is now a 35% chance of a U.S. recession around the up coming two a long time.

Deutsche Lender, which initially revealed its recession foundation case as late 2023, has explained a downturn by the end of the yr is probably if the Fed carries on its aggressive monetary tightening. In order to stay clear of big drawdowns in a broader portfolio, an allocation to Treasuries functions as an alternative to diversify possibility.

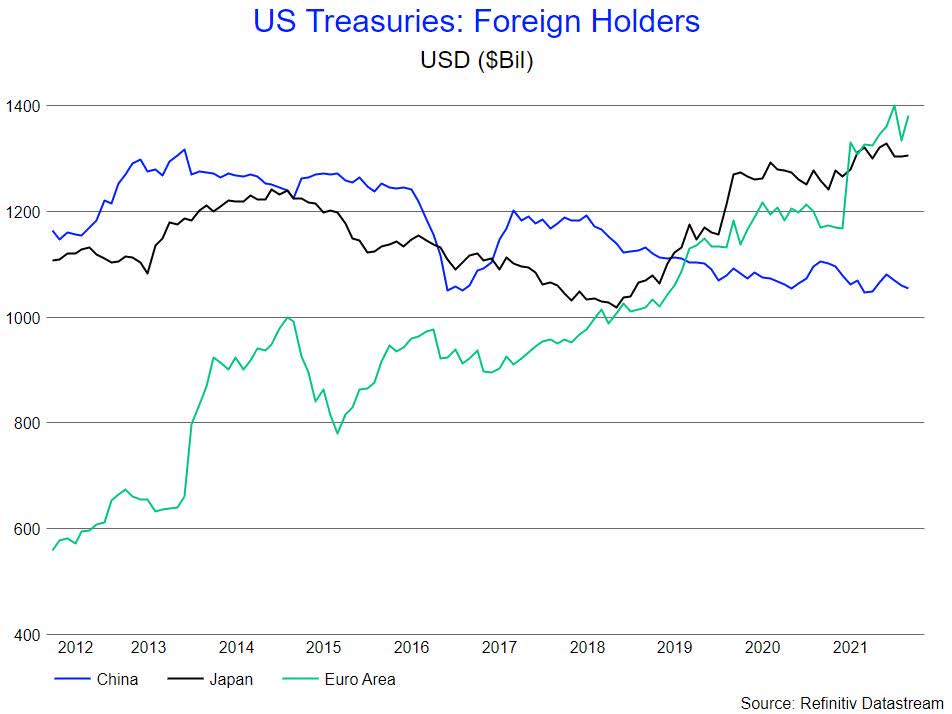

A 3rd viable pro of this Lipper classification in the specified ecosystem is the actuality that market place contributors could possibly think today’s costs by now element in the potential anticipations of increasing premiums. If that is the scenario, and yields rise considerably less than anticipated, the scenario for keeping lengthier-term bonds is a potent one particular – a stance many overseas buyers are betting on.

US Treasuries (Writer)

Editor’s Take note: The summary bullets for this write-up had been selected by Seeking Alpha editors.

[ad_2]

Source backlink