[ad_1]

Justin Sullivan/Getty Pictures Information

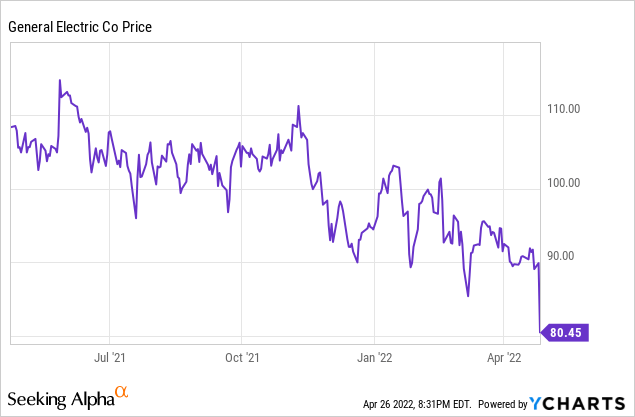

Standard Electric’s (NYSE:GE) turnaround plan strike some turbulence on Tuesday shares have been down by double-digits subsequent an underwhelming Q1 earnings report. With the decline, GE stock fell to new 52-7 days lows:

Judging just by the headlines, the earnings report failed to glance that bad. Earnings conquer expectations and revenues only arrived up a bit short. Even so, the company gave some fewer than encouraging guidance for the relaxation of 2022, and that set a destructive tone for the firm’s total earnings presentation.

A large component with this downbeat earnings report was that the supply chain complications ended up overshadowing almost everything else. As the corporation pointed out on its convention phone, get volumes were being up 13% organically this quarter. Appears fairly good. And still, revenues for the time period have been up a lot less than 1%.

People required to obtain more from GE but GE merely was not able to provide everything that shoppers experienced asked for. CEO Larry Culp explained that there have been supply chain constraints in “all” segments of the company, with distinct problems in well being treatment, aviation, electric power, and renewables. That’s a massive piece of GE’s in general income mix that has been impacted.

Offered GE’s shaky functionality around the earlier couple many years, it is straightforward to see why traders usually are not ready to tolerate any additional excuses from GE’s management crew. The inventory industry response on Tuesday definitely spoke to an traders base that is selling first and asking concerns later on.

From my looking through of other industrial companies’ earnings and commentary, on the other hand, I am not sure GE’s excuses are unreasonable. It looks managing multi-national producing supply chains is an exceptionally tricky endeavor right now. I’m not confident GE need to be notably punished, as in comparison to other industrial organizations, for what appears to be a deeply entrenched industry-huge dilemma.

Take the firm’s wind electrical power company. GE is losing funds there, presented all the supply chain problems, soaring input expenses, and reduction of some subsidies for the sector. Having said that, just about every person is losing income in the wind turbine company at the instant.

A Bloomberg report from February highlighted wind turbine makers as one particular of the hardest-hit sectors from the present financial shock. Marketplace chief Vestas (OTCPK:VWDRY) is having difficulties to crack even, whilst Siemens Gamesa Renewable Electricity (OTCPK:GCTAF) is shedding revenue and just fired its CEO.

A wind turbine is composed of roughly 85% steel, which has ballooned in value over the previous 12 months. Other inputs this kind of as copper have surged as very well. And wind turbines are massive cumbersome things which make for a logistical situation in any financial weather and a notably thorny one offered the prevalent port closures and other these kinds of goods.

So it is really not way too surprising that GE’s renewables division missing $434 million this quarter. Excluding that, the relaxation of the business enterprise did considerably much better. Of study course, a loss is a decline, and it is really not good that GE is losing revenue on the renewables front.

But it really is barely the company’s fault in particular that this division is underperforming. And, presumably, given all the ramifications for the electrical power market from the conflict in Ukraine alongside with sky substantial oil and fuel rates, governments will backstop the renewables sector even extra heading ahead. I wouldn’t rely on GE’s renewables small business remaining loss-earning for much too extended. Ideal now, even so, traders have to have patience to sit as a result of this downturn in profitability which arrives amid a historic bout of inflation and provide chain disruption.

More broadly, it is really easy to understand in a person perception why GE inventory is marketing off so sharply on these quarterly results. The forward assistance was instead underwhelming, and there had been loads of details in the report that never read through that wonderful either.

Nevertheless, factors this kind of as provide chain difficulties or earnings hits from the conflict in Russia are not main motorists to GE’s prolonged-term tale. If folks have the inventory, they really should have a favorable view of CEO Larry Culp and his capacity to allocate money. Culp was a person of the all-time good CEOs at an industrial firm, powering Danaher (DHR) to a just about 500% overall return during his tenure there. Danaher is an industrial conglomerate that was run by shrewd dealmaking, and the guess is that Culp can enhance GE’s enterprise with similar maneuvers. And he’s undoubtedly undertaking his greatest on that front GE has been extremely active in offer-generating.

It will not likely be quarterly earnings that make or break GE’s company turnaround but relatively its potential to preserve reshaping the enterprise.

Below Culp’s observe, GE has now paid out down more than $80 billion of personal debt through its asset sales and other this kind of moves. And now, the firm is established to split into three about the up coming handful of several years. Well being care and energy will turn into unbiased organizations by the close of 2024, further making it possible for GE’s buyers to mix and match among the the company’s belongings which hold the most guarantee.

In a year or two, we will most likely be searching at GE with exhilaration as the company’s all-crucial aviation business proceeds to decide on up steam. Airline traffic amounts have now topped pre-pandemic stages in some markets such as Mexico, and visitors data from the TSA for the United States has seemed more and more strong as perfectly. Airlines arrived by the pandemic in reasonably okay shape as far as their balance sheets go. The advent of sky significant jet fuel costs need to incentivize the purchasing of more recent extra gas-successful jets as airlines handle promptly altering economic problems.

The health care organization is also favorably tied to for a longer time-time period traits this kind of as demographics. GE’s imaging company has a strong franchise, competing in substantial component only with Siemens in quite a few situations. This should really give GE sturdy pricing electrical power as it discounts with the present-day inflationary shock.

In between now and then, having said that, it’s a little bit challenging to place a precise valuation on GE’s organization. Accounting earnings continue on to be small relative to what the company should get paid in normal occasions:

GE earnings estimates (Trying to find Alpha)

Analysts see the company building just $3.27 for every share this calendar year, which works out to all around a 25x forward P/E ratio on the now recent stock price of $80. Shares search far more affordable centered on predicted 2023 and 2024 earnings.

Nevertheless, there are a couple of caveats there. For 1, anticipate analyst estimates to arrive down immediately after these quarterly benefits. Yet another issue is that with the business enterprise split-offs coming up, GE will not likely be the identical company by 2024 that it is nowadays. It remains to be noticed just particularly how things these as earnings electrical power and debt will be split across the many new GE entities.

The organization won’t offer you a important dividend generate or any other this kind of metrics which would ordinarily place a lot of aid below a blue chip stock this kind of as this 1. As such, we can get the form of outsized promoting that we noticed Tuesday. The inventory will not appear low cost based on 2022 earnings, it can be not interesting as an earnings inventory currently, and people today just will not want to give Culp considerably leeway with the turnaround due to the fact GE has been a disappointment for so very long now.

That all makes perception. And it’s absolutely not captivating to check out to obtain into a slipping knife situation this sort of as this a single. Even so, for traders with endurance that want exposure to GE’s entire world-class firms, such as aviation, this hottest offer-off could make for a compelling entry level. The company’s attempts to spend down financial debt and completely transform its organization are rapidly coming to fruition, meanwhile the offer chain crisis will not very last endlessly. GE is bound to report some far better earnings quantities over the future yr, and this could be the relative very low level for investor sentiment all over the firm.

[ad_2]

Resource url